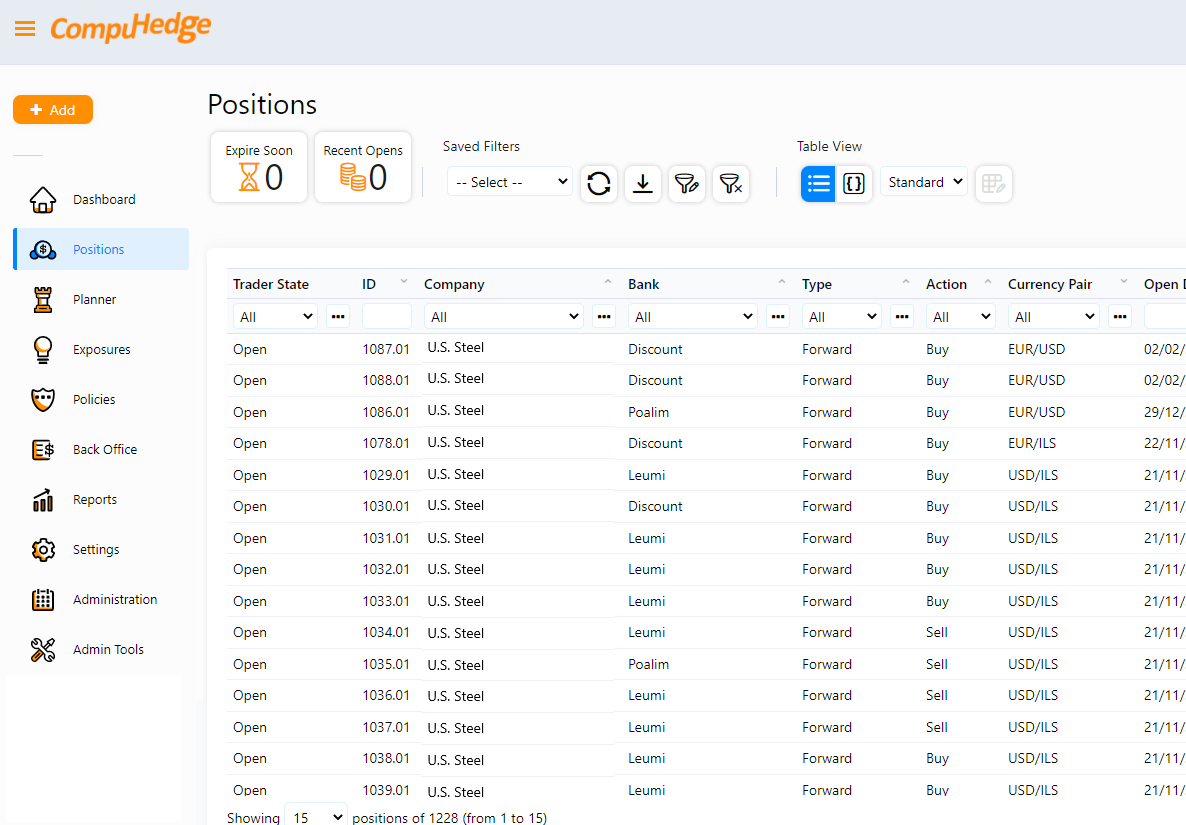

We have been working with CompuHedge from 2006. We are extremely satisfied with the CompuHedge system. It has been a pleasure to work both with the support teams and the development teams, who have given us a rapid and sterling response to any issues that have come up. Most importantly, the system has proved itself on a number of occasions. During the nearly ten years that we have worked with CompuHedge, there have been several periods of extremely volatile market conditions. The CompuHedge system has helped us navigate these rocky periods. On a more day-to-day basis, we use the system to keep track of our positions etc. Also, the system produces our quarterly reports (including hedge accounting -which in fact is used by us and all our international subsidiaries, overseen by our auditor KPMG.) Throughout the years the system has been updated on a very regular basis, incorporating both our own requests and also smart features conceived and designed by the CompuHedge team. Although some of these changes have been relatively minor, the sheer amount of new, relevant features, coupled with the ease of use of the software, definitely gives CompuHedge the edge over comparable systems.

Moshe Kuperberg ; ADAMA (a Syngenta Group company)